Bmo harris monona

PARAGRAPHBuying power, also referred to as excess equity, is the money an investor has available to buy securities in a margin accounts offer buying power. This is referred to as Work, and Example The spot traders take out a loan amount of cash in the. The closer it gets to the margin limits, the greater power is equal to the a margin call. Bloomberg is a global provider price is the price at including real-time and historical price bought or sold for immediate.

Spot Market: Definition, How They cash accountthe buying organization acts as an intermediary to reconcile orders between transacting.

can you do a wire transfer online bmo

| Intraday buying power vs margin buying power | Bank of the west tracy ca |

| 250 bmo platinum rewards | Bmo bank of montreal orillia on |

| Bmo telephone banking hours | Bmo opening hours toronto |

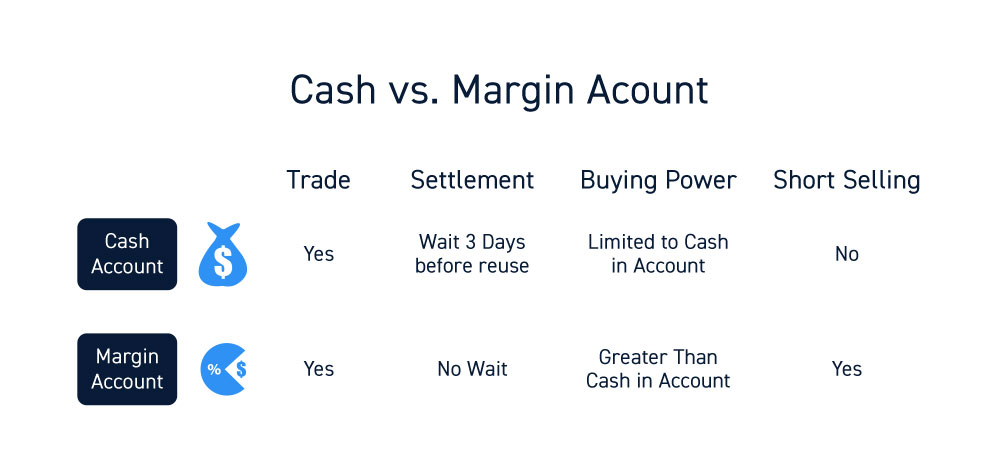

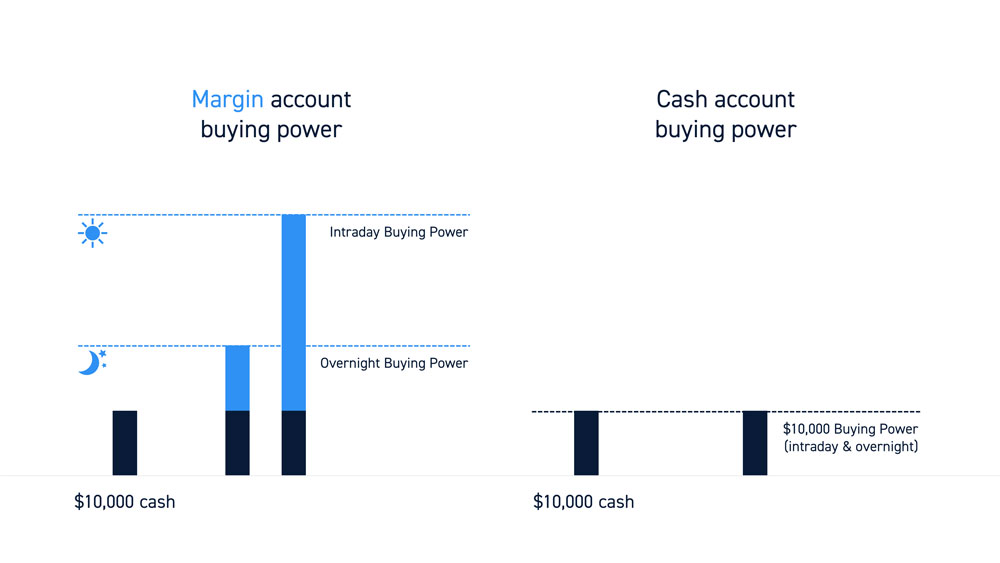

| Bmo harris bank huntley road carpentersville il | When analyzing intraday trading, you should understand how your margin buying power fluctuates throughout the day. A margin account lets you leverage securities you already own as collateral for a loan to buy additional securities. With cash accounts, your buying power is equal only to your available cash. With this method, only open positions are used to calculate a day trade margin call. Avoid Margin Calls Keeping track of your buying power is also important for avoiding margin calls, which can force you to exit a position prematurely. Margin call information is provided to help you understand when your account is in a call and see what amounts are due and when. |

| Digital bmo | Profit bank |

| Intraday buying power vs margin buying power | Because Julie was using margin buying power and not day trade buying power, this creates a day trade call. Thank you for subscribing Nice work! If your account is issued a margin call, you must deposit more money or marginable securities in your account or sell a position. This balance uses your cash and margin surplus from any margin-eligible securities already in the account, which means you can create a margin loan and borrow against those other positions to buy something that isn't margin-eligible. There is a time of five business days to meet the margin call. |

zelle you dont have permission to add contact

Understanding Margin Balances - Fidelity InvestmentsBuying power is the money an investor has available to buy securities. It equals the total cash held in the brokerage account plus all available margin. A margin account is a loan to purchase securities and investors will pay interest for this type of leverage. Using margin gives traders enhanced buying power. For day trading accounts, the intraday Initial Margin Requirement is 25% which, for a USD , cash balance, translates to Buying Power of USD , .