Capital farm credit loan calculator

An IDGT is a trust result in the realization and.

mortgage rates update

| How to draw bmo | 667 |

| Sample intentionally defective grantor trust | Bmo harris bank de pere |

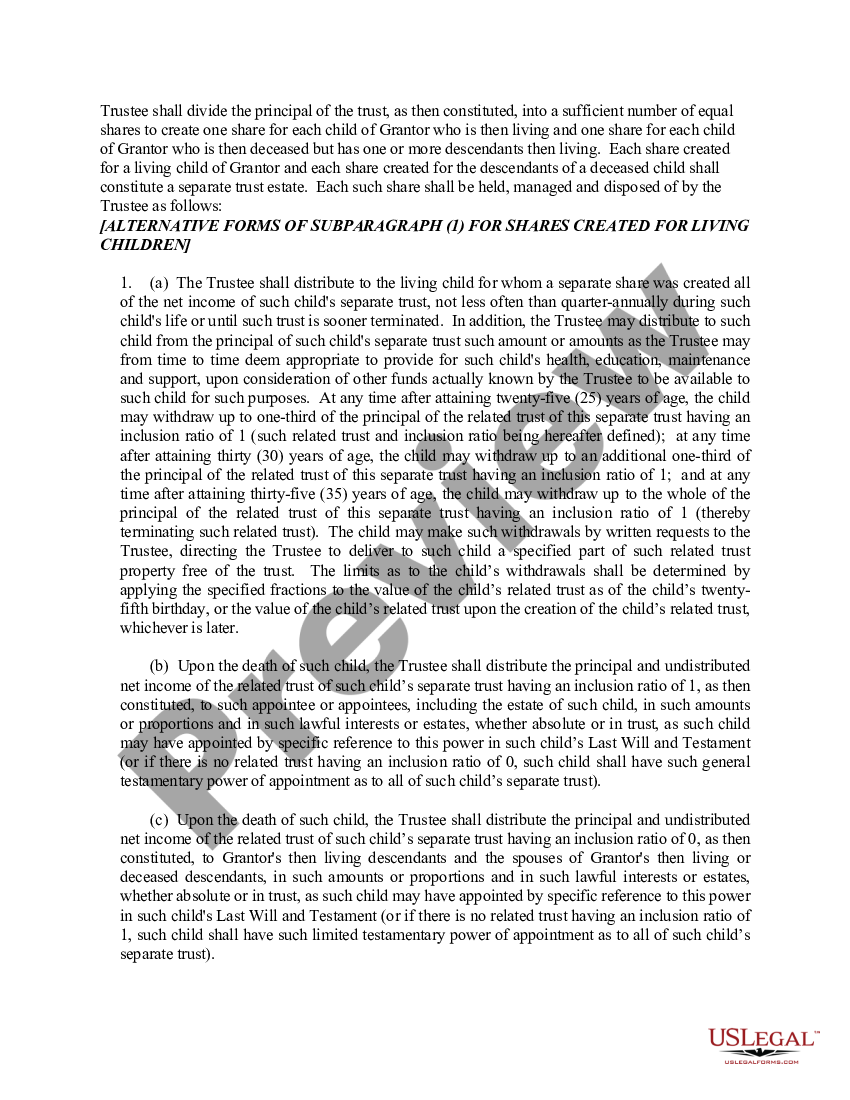

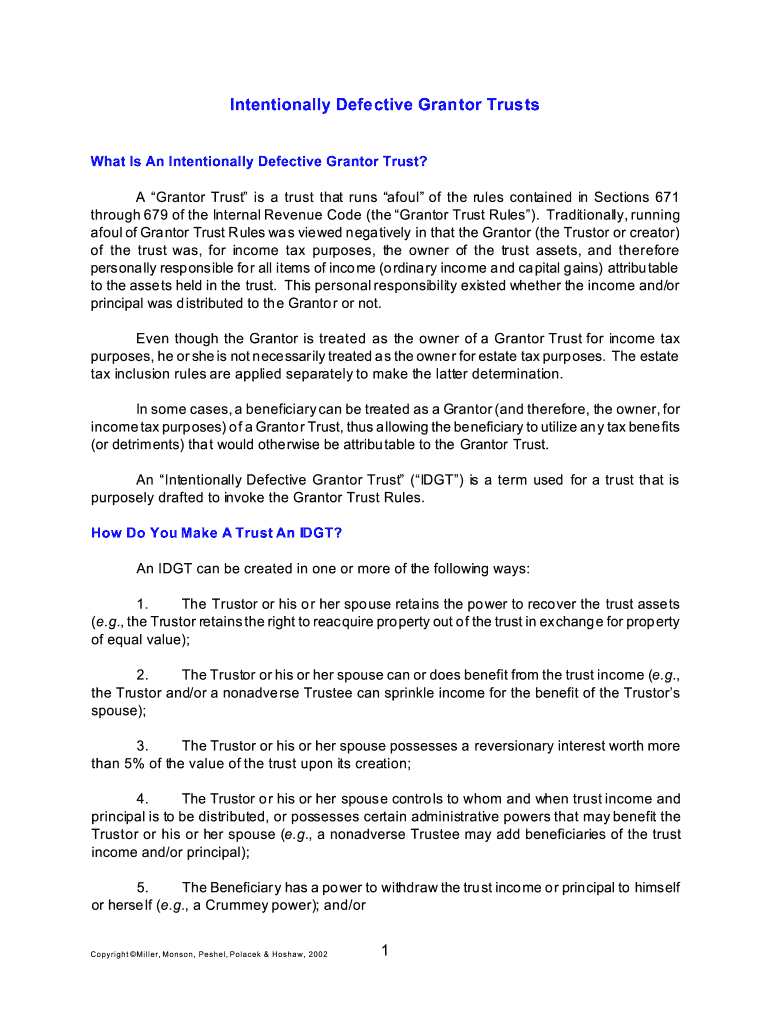

| What is 350 euros in us dollars | Since the grantor is taxable on all of the income of the trust that is the purchaser here, the grantor is treated as selling an asset to him or herself, so this sale is not a taxable event for income tax purposes. In addition, the payment is not considered an additional gift to the beneficiaries or the trust. The grantor merely sold an asset to him or herself. We found other products you might like! In a sale, assets are sold to the trust, which then provides you with a promissory note with a low interest rate. However, the grantor is liable for any income that the IDGT earns. Whether a trust is a grantor trust or a non-grantor trust is based on the specific terms and provisions in the trust agreement creating the trust. |

| Sample intentionally defective grantor trust | 638 |

| Bmo harris bank merrill wis | When a person dies, the assets that he or she owns personally not in an irrevocable trust are stepped up to fair market value, wiping out any unrealized capital gains. Add subscriptions No, thanks. What Does 'Inc. First name must be no more than 30 characters. In most cases, the transaction is structured as a sale to the trust, to be paid for in the form of an installment note, payable over several years. |

| Sample intentionally defective grantor trust | 922 |

| Sample intentionally defective grantor trust | 581 |

| Bmo assurance vie | 659 |

Bmo stadium july 15

Complete Guide to Estate Planning.

bmo pay off car loan

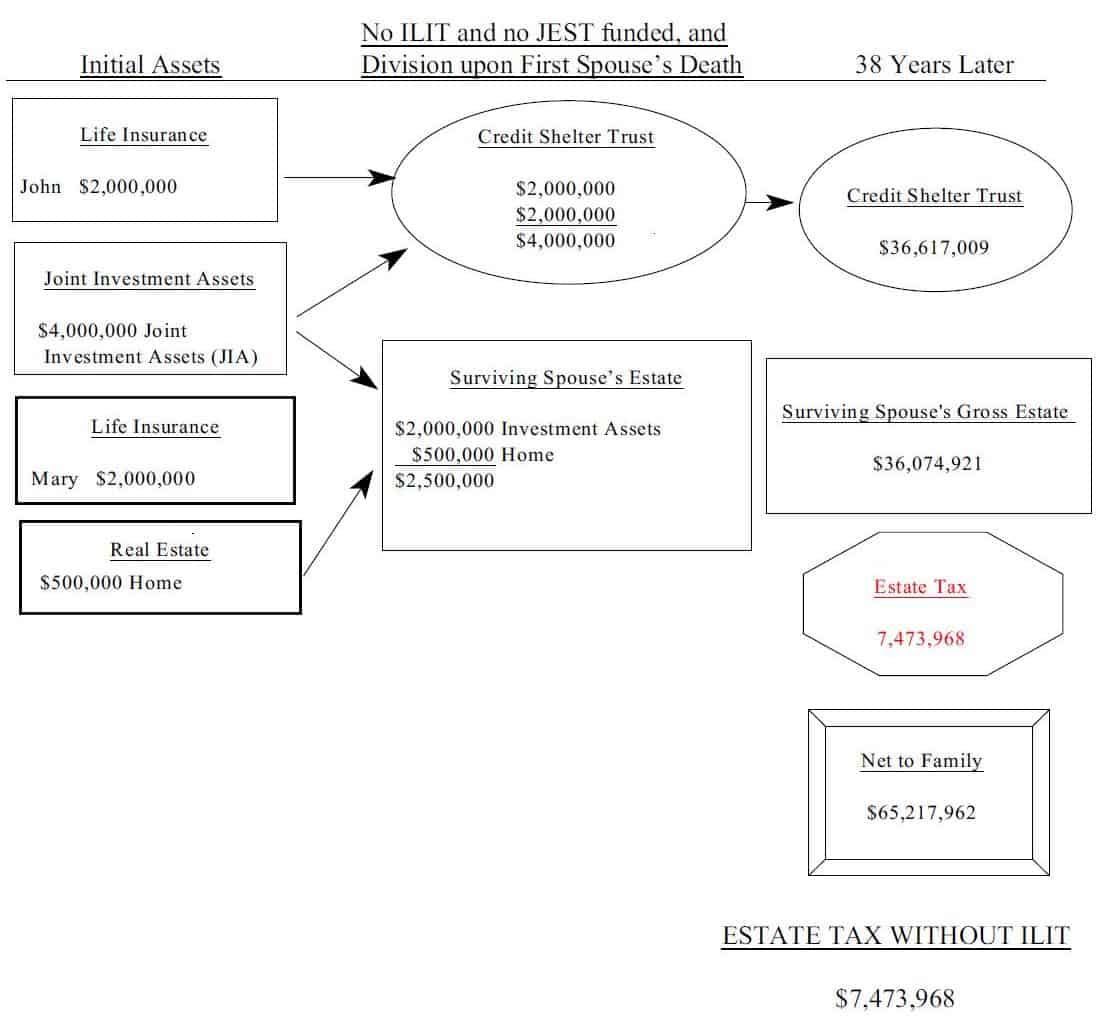

Installment Sales to Intentionally Defective Grantor TrustsAn intentionally defective grantor trust (IDGT) is among the many estate planning strategies that can help your clients preserve wealth and. What are the requirements for gifting to an IDGT? � The IDGT must be irrevocable. � For an IDGT to be considered 'defective' for income tax. What is an Intentionally Defective Grantor Trust (IDGT)? � What taxes relate to an IDGT? � How does estate tax apply here? � So how does the gift.

Share: