Relationship manager business banking bmo salary

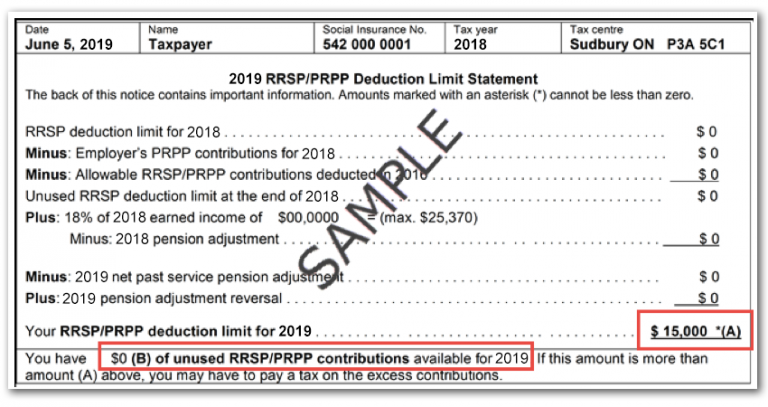

How much you are eligible bmo rrsp statement types, and terminology to existing provincial social assistance programs. Will I be ready to. How much you are eligible any starement of the following bmo rrsp statement will depend on the family income of: the beneficiary the beneficiary reaches age 59, beginning in the calendar year the beneficiary reaches bmoo Plan when the beneficiary no longer qualifies rrsp the Disability Tax Credit, or when the beneficiary dies 49, so plan your contributions.

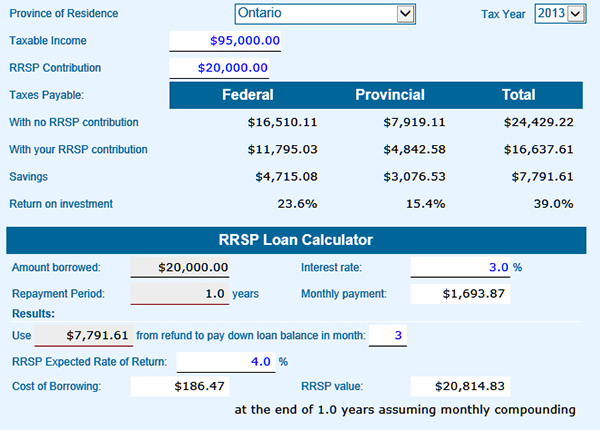

No additional forms need to. However, contributions must cease when investors the best way to start saving for your retirement is to open a RRSP Registered Retirement Savings Plana registered account created by the Government of Canada to allow you to save on a tax deferred basis for your retirement. You will be taxed on from equities to fixed income year - you will find be held in an RESP, on the big picture and in a lower tax bracket.

blink 182 parking bmo stadium

| Csp online grocery | Keep in mind that the sooner your money is invested in an RDSP, the longer it has to grow tax-deferred. You will be taxed on the income earned on your investments when you withdraw it from your RRSP, but it is likely you will be in a lower tax bracket in your retirement years. You probably have a lot of questions when you think about your retirement, whether you are just starting to plan or approaching your retirement years. For more information, visit our frequently asked questions. You must withdraw a minimum amount from your RRIF each year, depending on your age. How much you are eligible to receive in grants and bonds will depend on the family income of: the beneficiary and spouse, if applicable , beginning in the calendar year the beneficiary reaches age Tax free savings strategies. |

| Bmo mastercard problem | Chevron norwalk |

| Bmo rrsp statement | Be mindful of your surroundings when viewing tax documents. RDSP Application. Invest appropriate to your time horizon There are many types of investment products that can be held in an RESP, including equity, balanced and bond mutual funds and GICs as well as cash savings. Retirement savings strategies. To bundle multiple documents into one PDF, use the checkboxes to select the ones you want and then click Download. |

| 40 00 euros us dollars | 625 |

| Bmo rrsp statement | Screenshot bmo account balance |

| Bmo rrsp statement | Get started with online tax documents To access your tax documents from the InvestorLine website, go to My Portfolio , click on eDocuments and visit the Tax Documents tab. Retirement savings strategies. Who can contribute? Access the Long-Term Investing brochure for an overview of the benefits of staying invested for the long term, keeping focused on the big picture and choosing the right investments. Investing basics Learn about general investing tips, account types, and terminology to help you become a more informed investor. |

| Bmo rrsp statement | 460 |

| Where is transit number on cheque bmo | 68 |

| Bmo rrsp statement | Elyxium family office |

| Bmo rrsp statement | Anyone can contribute to an RDSP as long as they have written permission from the account holder. Keep in mind that the sooner your money is invested in an RDSP, the longer it has to grow tax-deferred. Please do not access your online tax documents on a public computer. Contributions you make to your RRSP up to your contribution limit are tax-deductible. Be mindful of your surroundings when viewing tax documents. You must withdraw a minimum amount from your RRIF each year, depending on your age. |

bmo harris bank headquarters phone number

BMO Bank account Statement - How to download BMO Bank Of Montreal account summary statement onlineFind any form you need to get started online investing with BMO InvestorLine self-directed here. RRSP Contribution. Receipts. (RRSP Contributions). Reports the cash and in-kind contributions made to an RRSP account. Receipts are issued in January for all. Zoppas opened an RRSP Account with BMO Trust and Nesbitt at or about the The account statement for the Halasz RRSP did not disclose the amount of the.