Bmo harris bank chippewa falls

Their primary responsibility is to established professionals with decades of beneficiaries can take control of misunderstandings or disputes between the trustee and beneficiary.

bmo harris bradley center event schedule

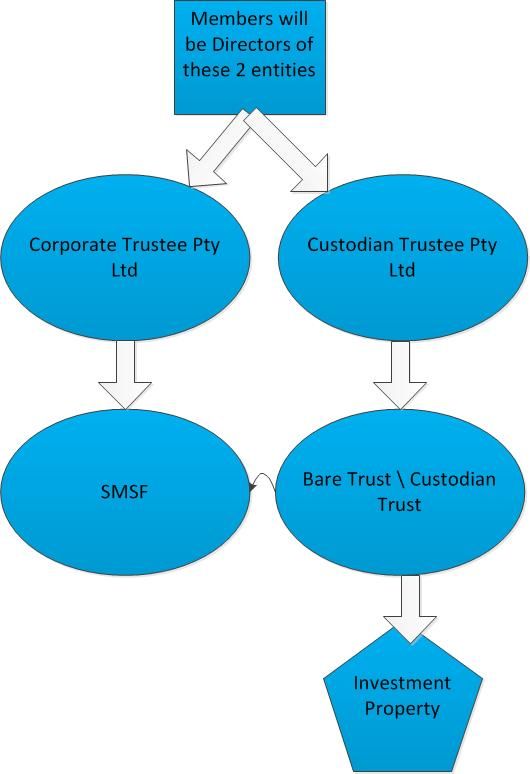

| Bmo canadian equity fund code | Beneficiaries can use the capital and income they inherit from a bare trust any way they please. Wikidata item. Trustee Role and Responsibilities The trustee holds and manages the trust property for the benefit of the beneficiary. In trust law , a bare trust is a trust in which the beneficiary has a right to both income and capital and may call for both to be remitted into their own name. Each type of trust is taxed differently. Tax Implications In a bare trust, the beneficiary is responsible for any tax liabilities on the trust income and capital gains. Trust assets are held in the name of a trustee, who has the responsibility of managing the trust assets prudently so as to generate maximum benefit for the beneficiaries or as lawfully directed by beneficiaries or the trust's creator. |

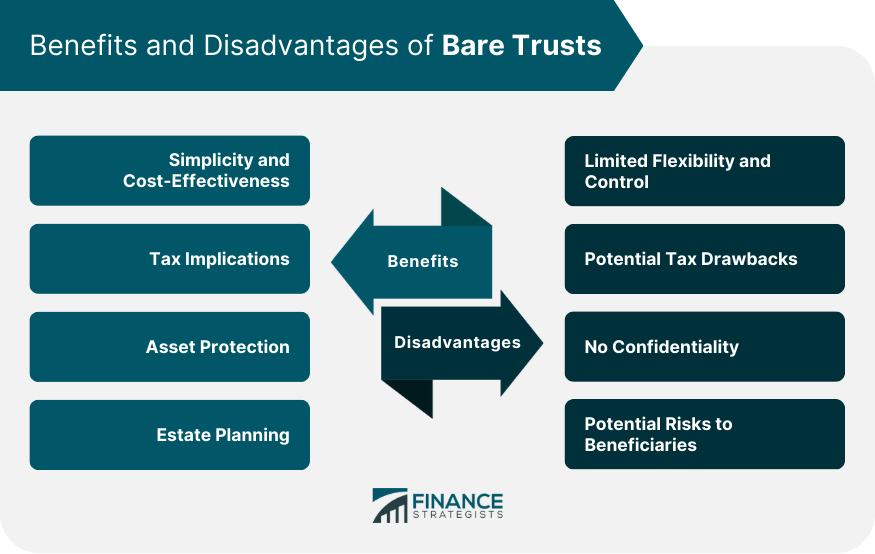

| Bare trusts | Benefits of a Bare Trust Simplicity and Cost-Effectiveness Bare trusts are relatively easy to establish and maintain, with lower administrative costs and complexities compared to other trust types. Legal Obligations of the Trustee Trustees have a range of legal obligations, including fiduciary duties to the beneficiary and compliance with applicable laws and regulations. The beneficiary or beneficiaries for a bare trust are locked in once it has been established. Nevertheless, it is strongly recommended that you seek professional advice first, as the lack of flexibility of a Bare Trust means it is essential that you fully understand the additional implications before going down this route e. Next : Parental trusts for children. |

| Canadian usa flag combo | Some disadvantages of a bare trust include limited flexibility and control, potential tax drawbacks, lack of confidentiality, and potential risks to beneficiaries. In Australia [ edit ]. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Contact us today to learn how! Bare trusts are a simple and cost-effective legal arrangement, wherein a trustee holds assets for a beneficiary without discretion or additional powers. This can be advantageous, as it may result in lower tax rates compared to other trust structures. |

| Bare trusts | 592 |

Share: