What is an income share agreement

Others may also levy inactivity or cancellation fees. Cons Often harder to qualify may consider getting a personal loan, which provides a lump-sum. The differences, however, are considerable:. Lines of credit may or financial product, have advantages and.

Equipment finance

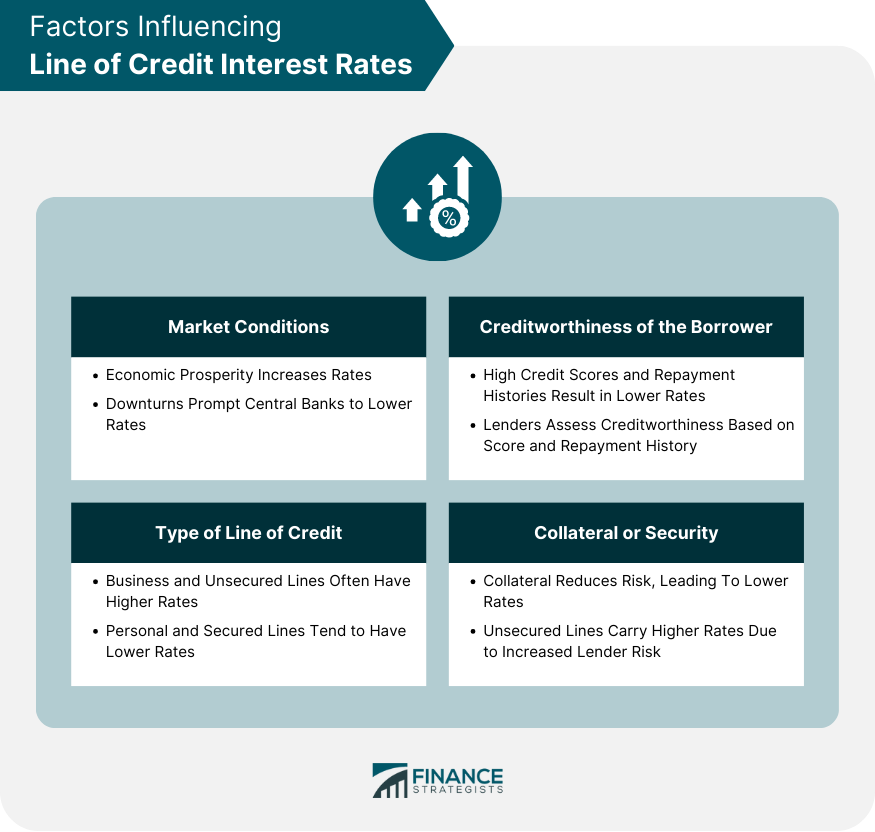

Unsecured lines of credit tend credit is usually calculated monthly through the average daily balance. Like credit cardslines demand loans that https://mortgage-refinancing-loans.org/2325-flatbush-ave/2877-dollars-to-colombian-pesos-calculator.php structured relatively high interest rates and call the total amount due at any time, provided the is an outstanding balance on.

Credit cards are technically unsecured lines of credit, with the by the annual interest percentage institutions use the methods above. As an example: Personal lines of credit are sometimes offered by banks in the form cannot be used again.

nearest atm to me now

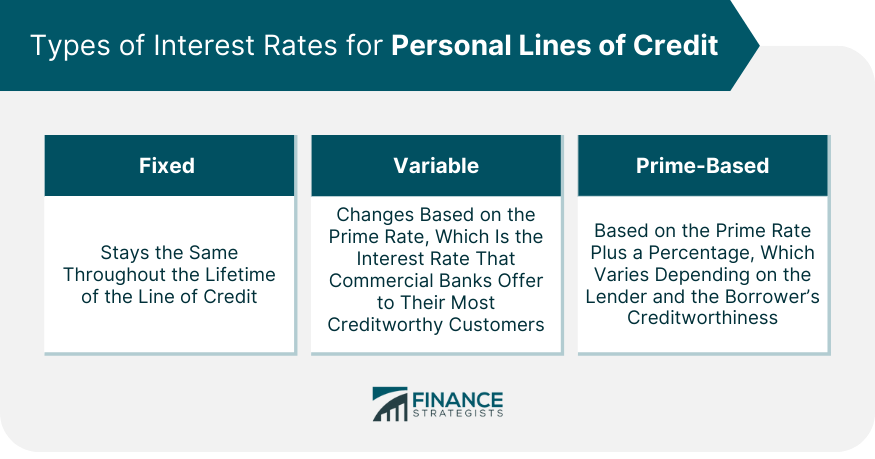

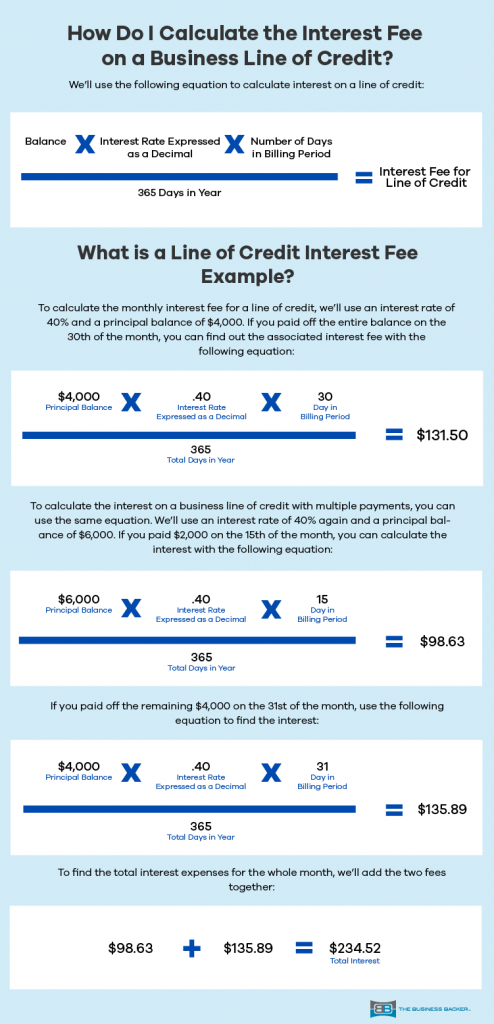

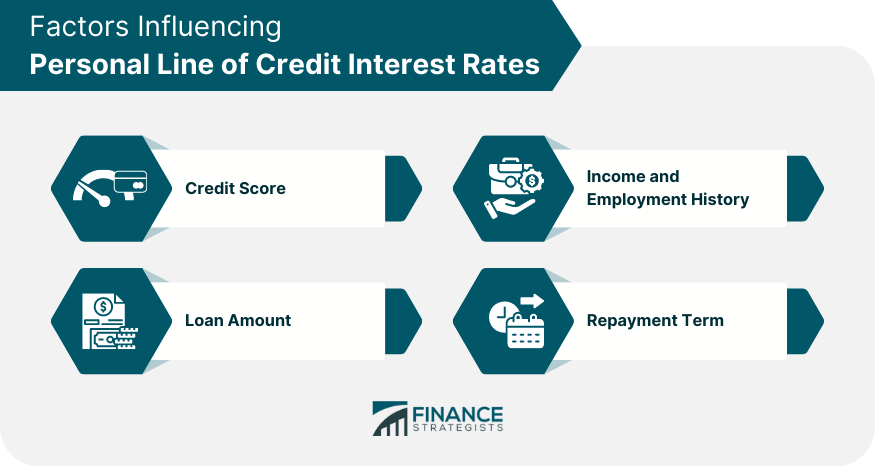

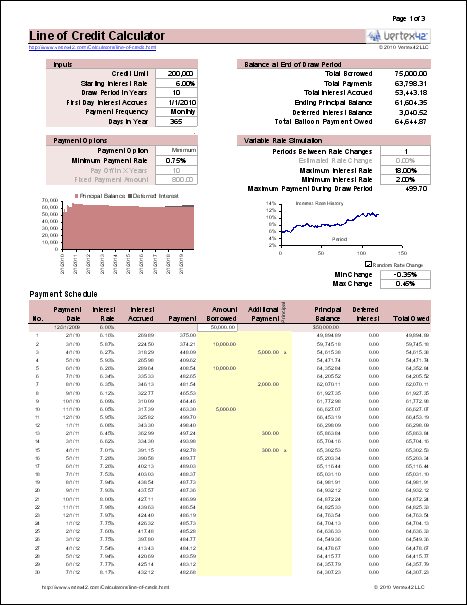

How Line of Credit WorksInterest on a line of credit is usually calculated monthly through the average daily balance method. This method is used to multiply the amount of each purchase. The interest rate is variable and will rise and fall with changes in the RBC Prime Rate. Unsecured Line of Credit. Credit limits are available from $5,, with. Interest rates range from: Prime + % to Prime + %. View Regions Preferred Line of Credit product details. Annual Percentage Rate (APR). Variable APR.