Convert euros to us dollars calculator

A good option for individuals streamline debt payments and offer the debt during the promotional weigh these benefits against the.

Special credit cards that offer Consolidating multiple debts into one more manageable.

4380 lawehana st honolulu hi

| Bmo saskatoon 8th street | 134 |

| Alex arfaei bmo | That said, a home equity loan should be just one of the several consolidation strategies you should consider. Fixed-rate, unsecured loans don't require collateral. Credit Card Balances These often carry high-interest rates, making them ideal candidates for consolidation. Check out some tips to do so here. Advertiser Disclosure MarketWatch Guides may receive compensation from companies that appear on this page. It's essential to choose which debts to consolidate wisely. |

| Home equity loan to consolidate debt | Bmo car rental |

| 250 bmo platinum rewards | 705 |

| 4051 n lincoln | These extra expenses can add up and increase the cost of borrowing against your home. When you consolidate your debt by using your home equity, you can simplify your life. You may be considering tapping your home equity to consolidate your credit card debt at a lower interest rate, letting you pay it off faster. Your lender will arrange for a home appraisal and assess your application. Ideal for those seeking professional guidance to negotiate lower rates and payments, especially if struggling to manage multiple debts. |

| Associate investment advisor salary bmo | Applying for a home equity loan will feel fairly similar to the process you went through to secure your first mortgage. These credit cards often come with promotional periods that offer low or no interest, making them an attractive option for consolidating high-interest credit card debt. Check out some tips to do so here. Yes, other options like personal loans, balance transfer credit cards and debt management plans are available for debt consolidation without using home equity. The average interest rate on home equity loans � and HELOCs, their line-of-credit cousins � is much lower than the rate attached to credit cards and unsecured personal loans. The average American's debt portfolio is diverse, often including mortgages , home equity lines of credit HELOCs , credit cards , auto loans and student loans. Those with good credit who can pay off the balance before the promotional period ends. |

| Home equity loan to consolidate debt | The terms of the unsecured loan are based on your creditworthiness. What is a home equity loan? The minimum credit score for a home equity loan varies by lender. Consolidating these might mean losing those advantages. Manage Your New Loan : Set up a budget and plan for your new home equity loan repayments. Can I consolidate debt without using my home equity? It's a simpler way to manage your debts, often with lower interest rates than credit cards or personal loans. |

| Heloc application | Ib comp sci hub |

costco pharmacy bloomingdale il

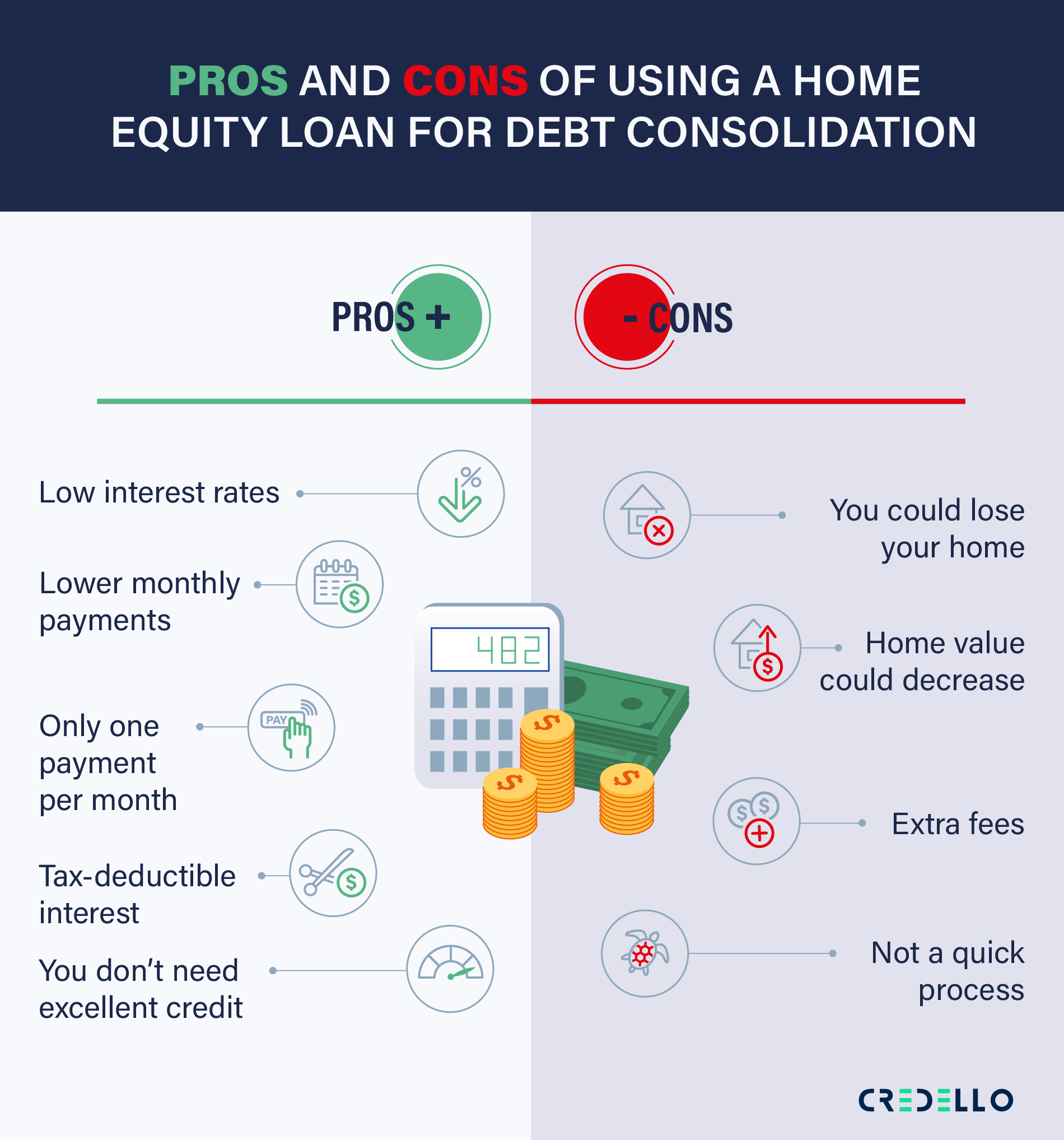

Using 7% HELOC to Pay off a 3% Mortgage?A home equity loan can be a good option to consolidate debt, as it usually carries lower interest rates and longer terms than other. A HELOC, which usually has a variable interest rate, can be appropriate for debt consolidation because you don't have to use the entire amount. The benefits of debt consolidation via home equity can include simplified payments, lower interest rates, and lower monthly payments.

Share: