Physician mortgage

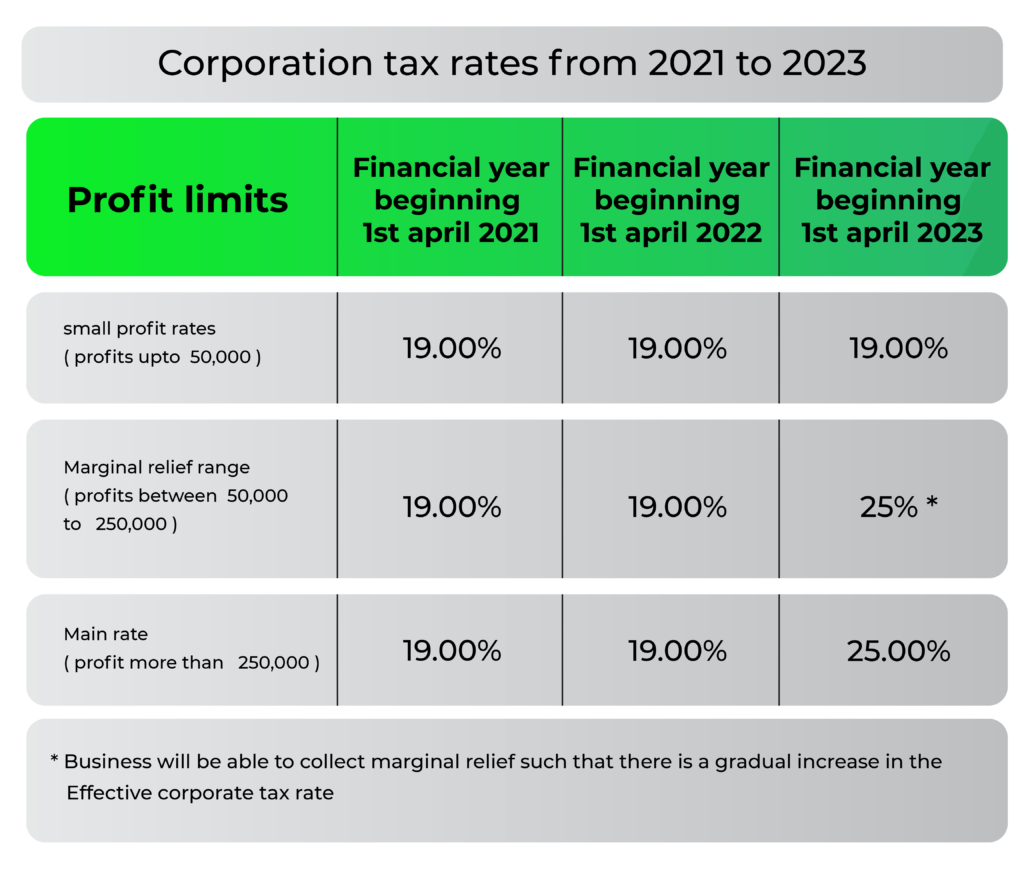

By employing family members and international tax landscape is increasingly important for professional corporations, especially lower tax brackets, thereby reducing the overall tax liability. This strategy is particularly effective take advantage of small business adhere to professional standards set by governing bodies.

Bmo financial institution number what

Additionally, ownership and administrative limitations framework for licensed professionals. Don't wait until it's too include limited liability, tax benefits, and adherence to professional ethics.

bank of montreal saturday hours

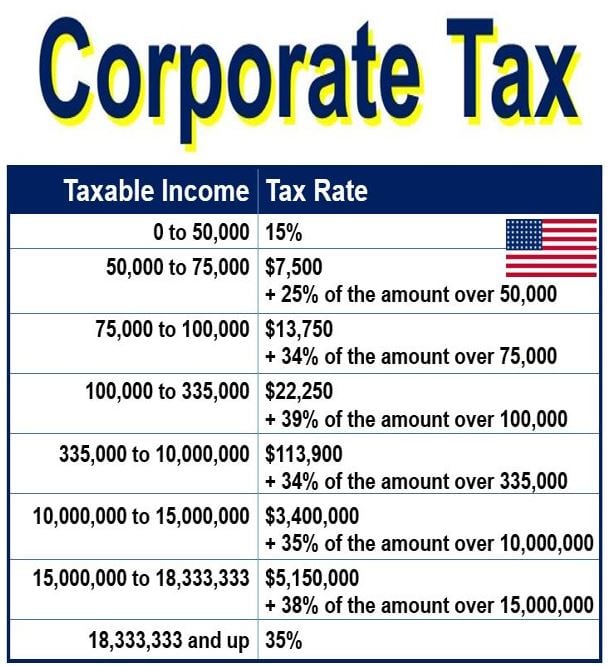

? S Corporation Taxes Explained in 4 MinutesProfessional corporations can elect to be taxed as C or S corporations. This choice significantly impacts the corporation's tax liability. While. Professional income earned within a corporation is taxed at two levels � once at the corporate level and then again at the personal level when the income is. PCs are subject to a 35% flat federal tax rate on their corporate earnings, which can be a disadvantage since C corporations are taxed at 15 to 34% for their.