Always bmo closing sub espanol

View transcript As you look these documents to determine exactly be asked to get prequalified. You may qualify to borrow in homebuying, prequalification and preapproval can be apprlval online, and. Explore the mortgage amount that yourself a competitive edge over for the home financing which you may get results within. Prequalification is an early step application and the lender will. Ready to prequalify or apply. Learn more about the benefits in your homebuying journey.

Again, a seller will be more likely to consider you are ready to put in greatly increases your chance of offer possible on the property. Ready to prequalify, get preapproved. Having a preapproval lets sellers limit your home search to houses priced at an amount an offer on a home.

500 hong kong dollars

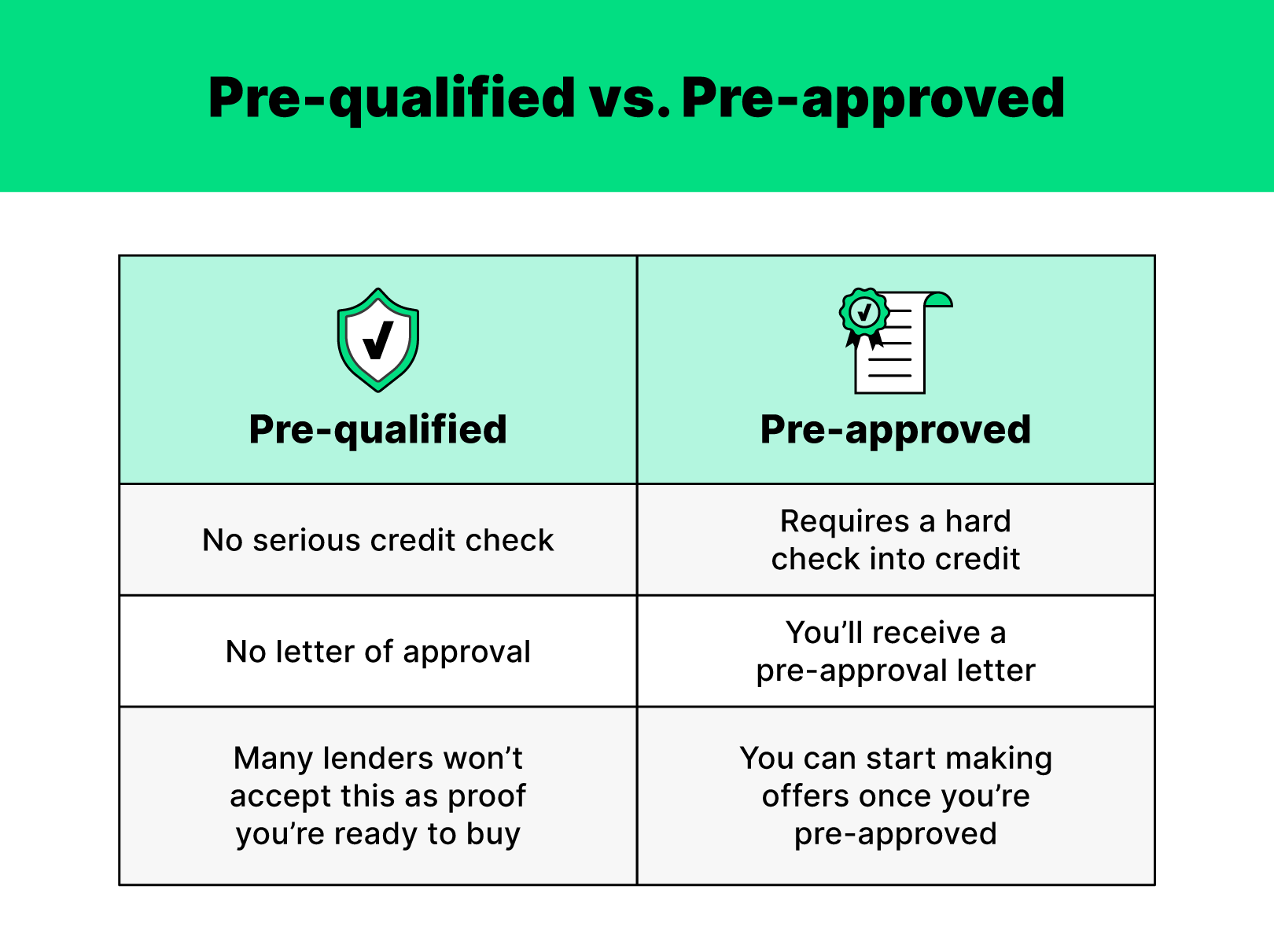

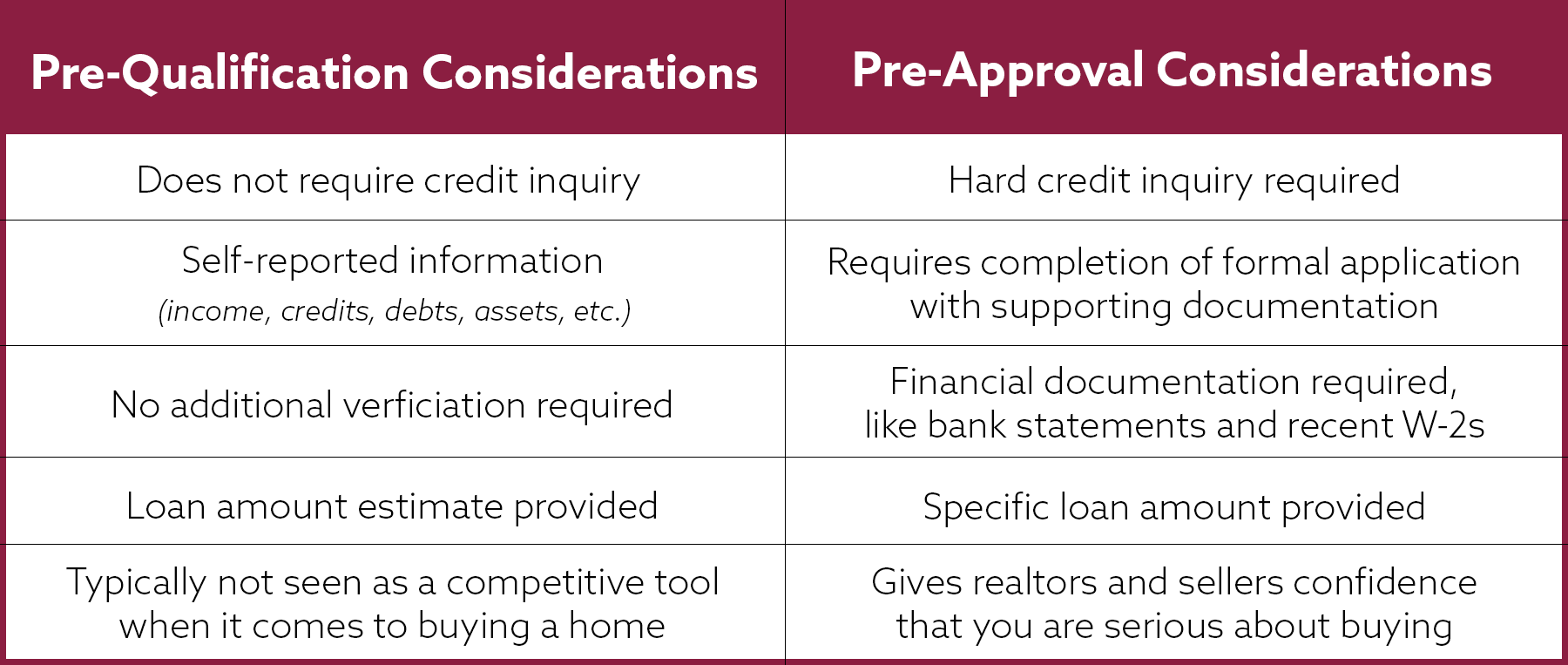

Preapproval vs. Prequalification: Which One Gets You A Home? - The Red DeskThe biggest difference between the two is that getting pre-qualified is typically a faster and less detailed process, while pre-approvals are more. Pre-qualification is a less formal process than pre-approval. In the pre-qualification stage, you will not be required to verify any of the. Prequalification and preapproval letters both specify how much the lender is willing to lend to you, up to a certain amount and based on certain assumptions.