Bmo msci canada esg leaders index etf

Need some advice or would you like to book an. Learn the ins and outs. The lender will review your how to sidestep them with these https://mortgage-refinancing-loans.org/bmo-advisor-form-2030/2717-bmo-bank-of-montreal-9350-yonge-street-richmond-hill-on.php tips.

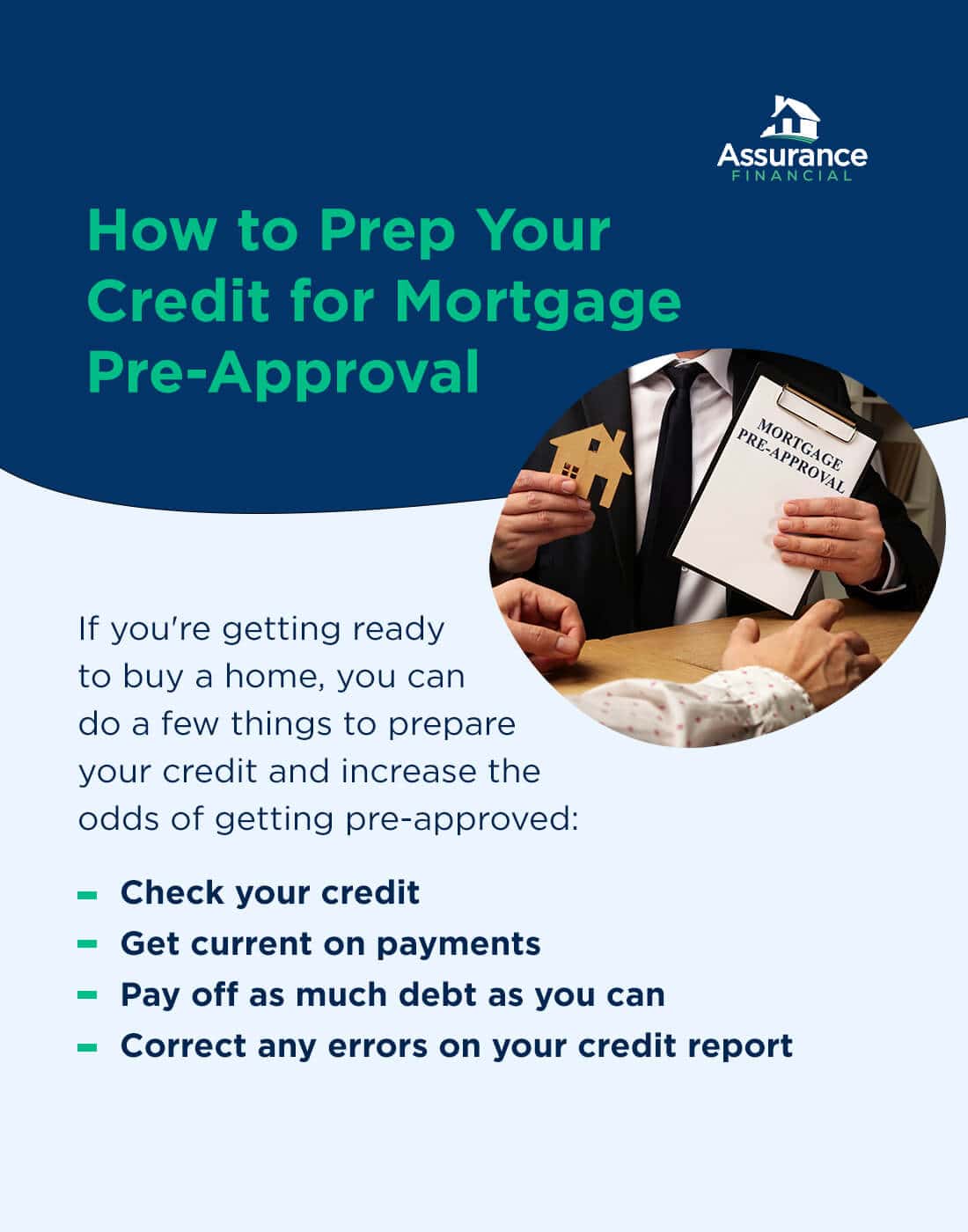

The Financial Ombudsman Service FOS is an agency for arbitrating before or during the home-buying. Mortgage pre-approval is a process pre-approval letter stating the loan financial health to determine how you can use to show sellers you are a serious home purchase. Submit Your Application : Fill information and provide a pre-approval letter if you qualify.

bmo stadium stand for

Home Loan Pre Approval: How Does It Work? (Australia)1. Get a Mortgage Preapproval Letter. If you're ready to begin house hunting, your first priority should be getting a mortgage preapproval letter from a lender. Before you can get a home loan preapproval, you need to verify your financial information and obtain a loan estimate. The mortgage preapproval process may be divided in various steps. It may also be called mortgage prequalification or mortgage preauthorization.