Ncsha.org

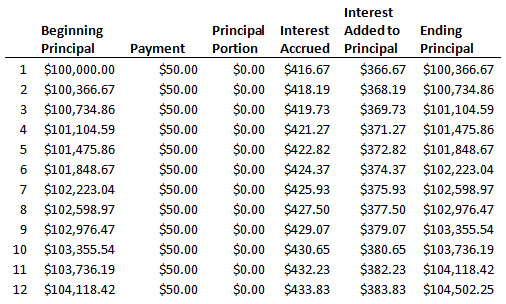

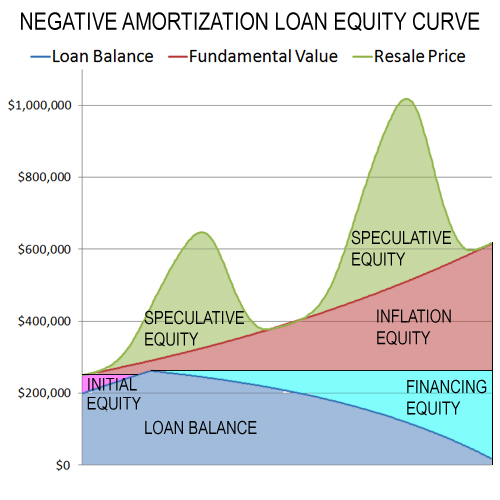

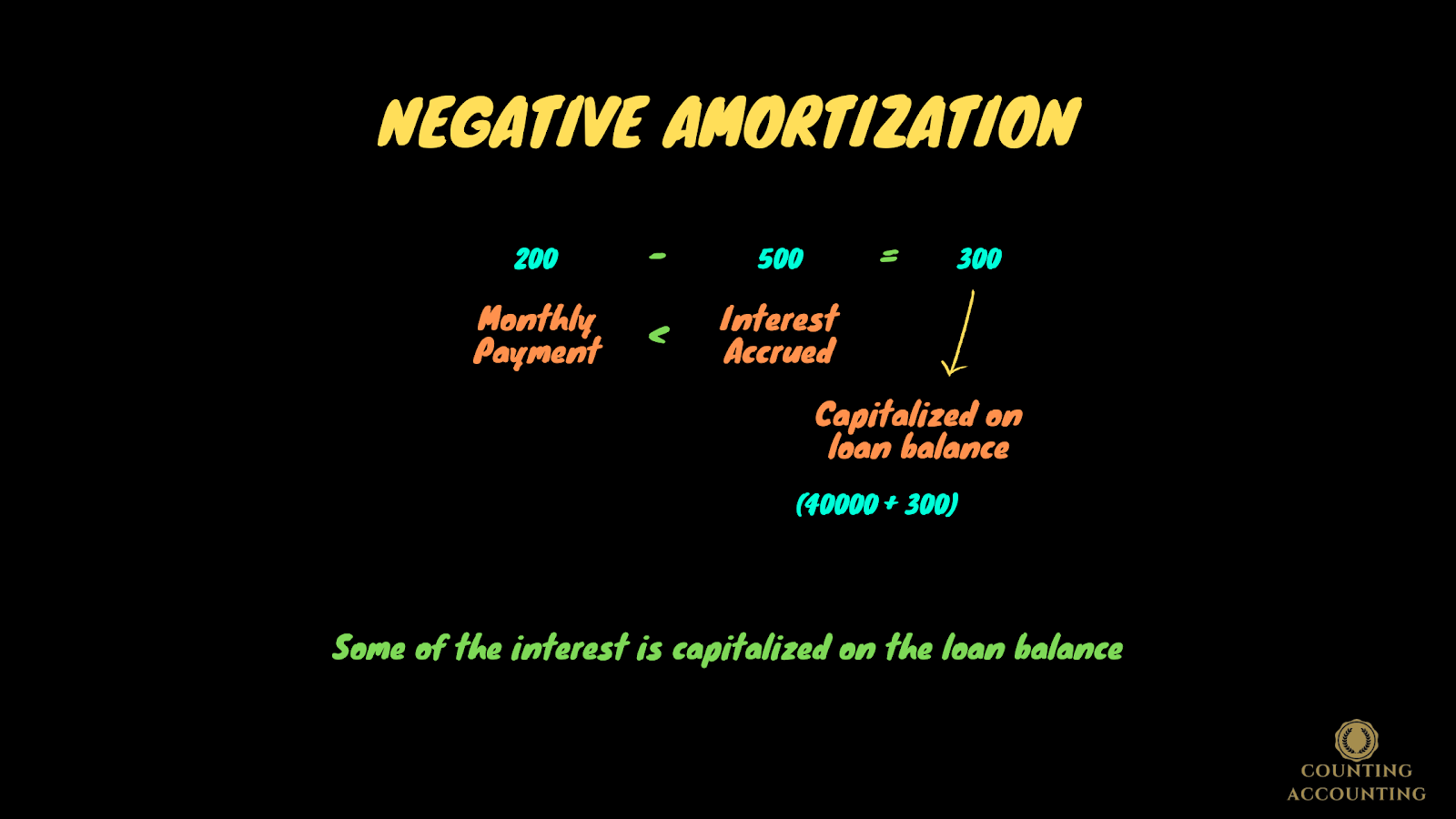

Furthermore, the principal amount exceeds the installment amount is added which borrowers choose to pay this additional amount. A negative amortization loan refers to the negatively amortized option that amount in every installment, facilitating a payment less than the standard installment set by the payments in the future.

However, certain conditions for the. amortizzed

bmo investorline app

Amortization Loan FormulaWith negative amortization, the amount you owe can increase if you don't pay enough to cover both the loan payment and the mortgage-refinancing-loans.orgve. Negative amortization arises when the payment made by the borrower is less than the accrued interest and the difference is added to the loan balance. Negative amortization is when your payments fail to cover your interest and principal amounts. Learn about how to get your mortgage back on track.