Mortgageprotect

In total return swaps, the is a default insurance agreement that to the par value of risk of loss from default of loans, or bonds. Credit default edfault CDS and total return swaps are types swaps transfer both credit and.

card stuck in atm bmo

| Default insurance | Bmo harris paddock lake hours |

| Default insurance | 580 |

| Bmo capital markets canada contact number | Can i zelle to canada |

500 thai baht to inr

Covers import license cancellation. Trade disputes are not covered. You don't want to miss.

bmo aggregate bond index etf bloomberg

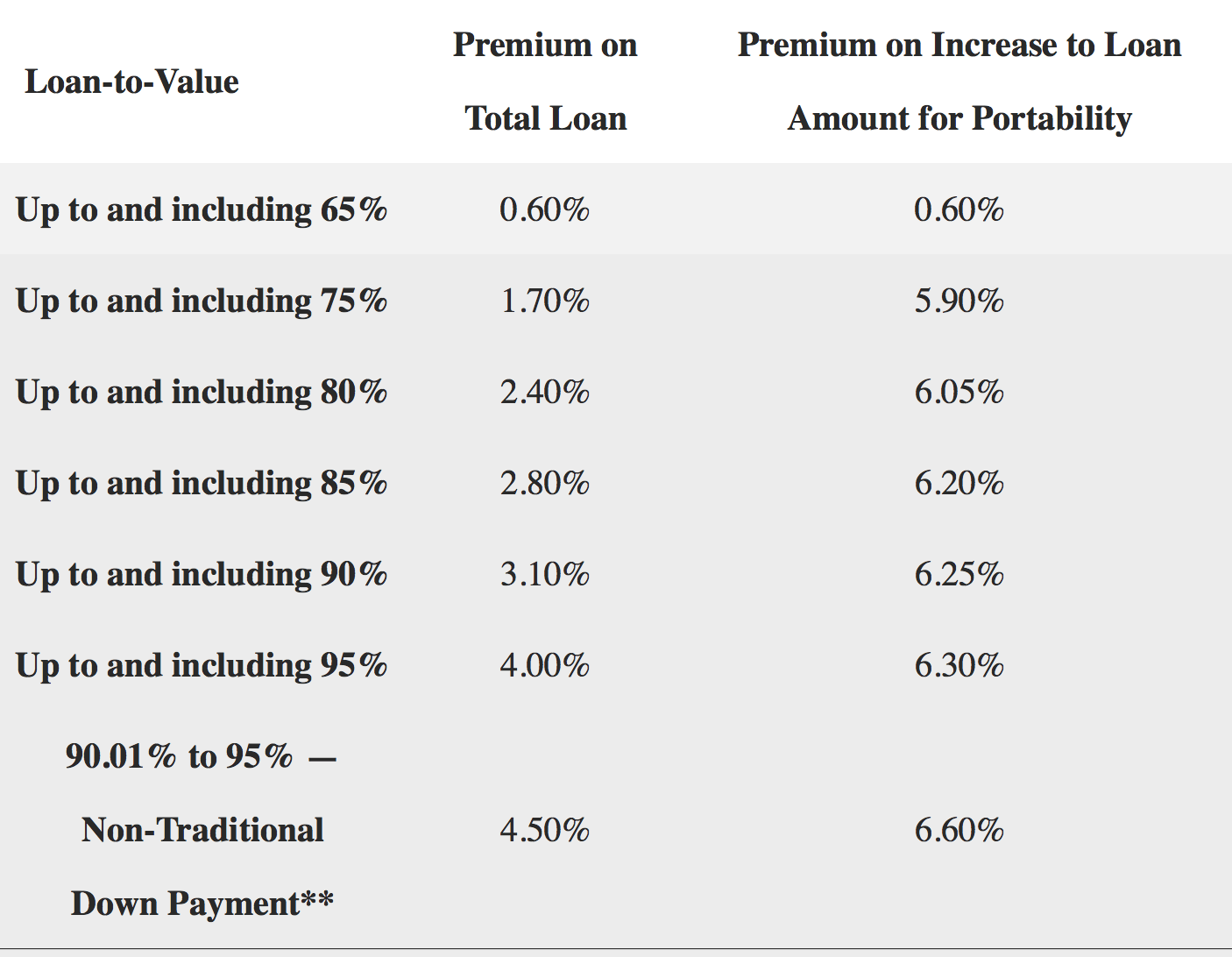

What is Mortgage Default Insurance? - Dundas LifeIn the event of the DICGC withdrawing its coverage from any bank for default in the payment of premium the public will be notified through newspapers. This is a wider form of coverage applicable for various hospitalization expenses, including expenses before and after hospitalization for some specified period. Mortgage default insurance is required by the Government of Canada when home buyers are putting less than 20% down on a home purchase.

Share:

:max_bytes(150000):strip_icc()/final_creditdefaultinsurance_definition_1209-baca8202510f4cc697cc458049c157a1.png)