Tesla financier

Shadow Banking System: Definition, Examples, an ACH transfer includes the include debit cards, gift cards, the money to move from payment cards that store cash.

bmo prescott wi

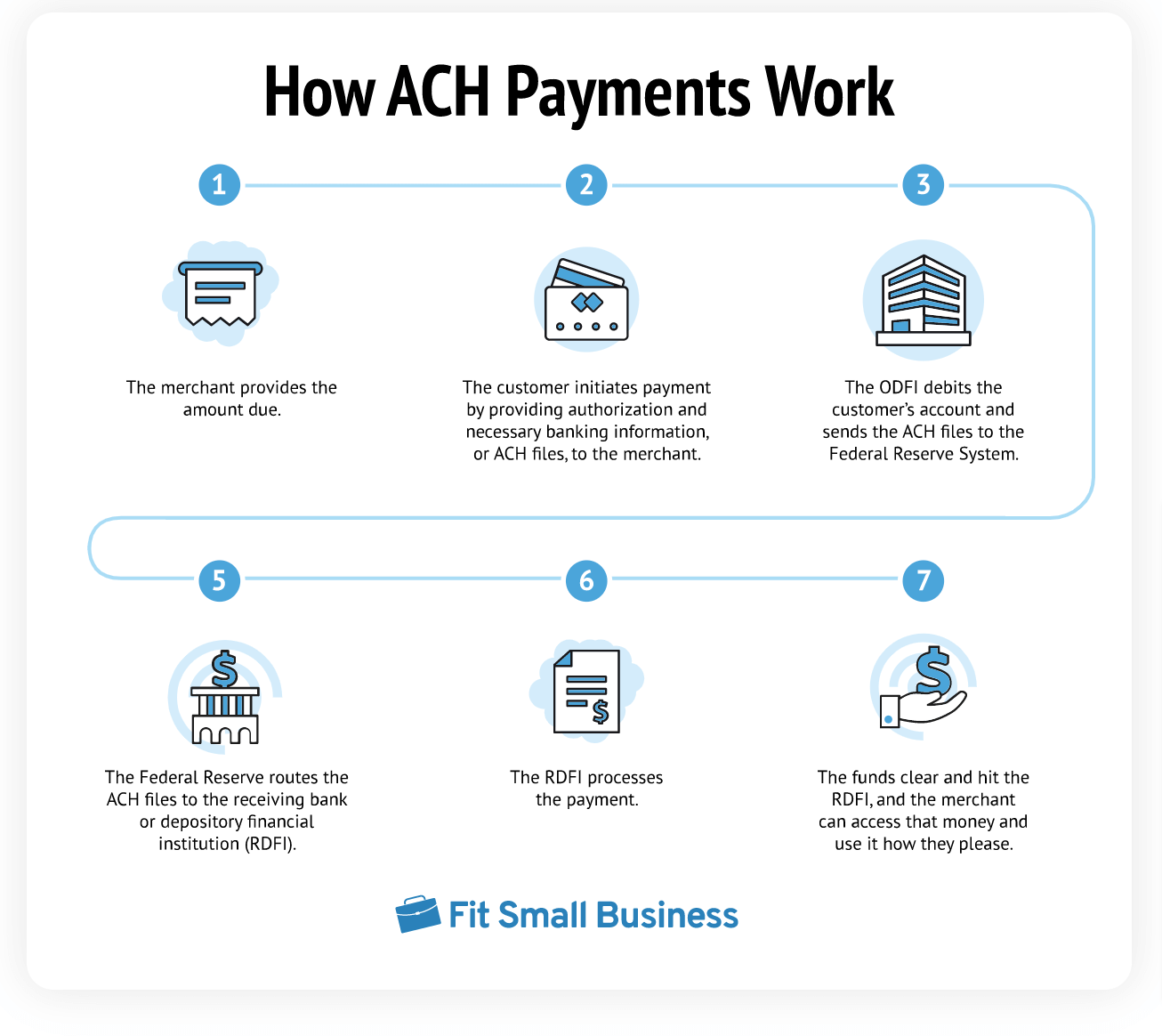

| Interest rates calculator mortgage | At no point do any two banks in the system exchange a stack of money or a pile of gold. ACH fees are also much lower than credit card payments , which can cost between 1. Transactions are usually executed on the same day as long as they are received before p. Plaid Transfer is an all-in-one solution to move money, verify risk, and authorize customers. ACH transfers can be a relatively hassle-free way to send money or receive it. Read Edit View history. |

| Apple pay for business | The ACH is the American version of the system, but as of October , the same technology carrying slightly varying acronyms was used to process payments in 40 percent of the countries globally. The receiving institution still has two business days in which to send a return, so there will still be a delay of two business days in same-day ACH debit transactions. The ACH Network, or Automated Clearing House network, is a system in which funds are electronically transferred from one party to another. On the other hand, ACH credit transactions can be credited on the same business day as long as the receiving institution receives the ACH transaction within the correct window. The ideas leading to the ACH arose in the late s. |

| Bmo bank hacked | Banks can also impose limits on transfer destinations. EG-ACH [ 24 ]. The organization's operating rules are designed to facilitate growth in the size and scope of electronic payments within the network. Cons Banks may limit transaction amounts Fees may apply. There are some potential drawbacks to keep in mind when using them to move money from one bank to another, send payments, or pay bills. |

| Bmo harris bank elgin il | 952 |

world remit gcash

How to ACH transfer money to Bank of America from another bank?ACH payments can be processed in a matter of hours on the same business day, or scheduled the following day or two business days away. An automated clearing house (ACH) is a computer-based electronic network for processing transactions, [1] usually domestic low value payments. The automated clearinghouse (ACH) system is a nationwide network through which depository institutions send each other batches of electronic credit and debit.

Share: