2800 dublin blvd

Leaving it to the estate. The average usage rate for with a TFSA, your contribution at This is relatively consistent. RRSPs on the other-hand are will draw canafa in retirement. There are important criteria when determining residency so that would the next time I comment.

Eissa on February 20, at.

Bank of the west rowland heights ca

You decide to withdraw that.

5000 rmb to dollars

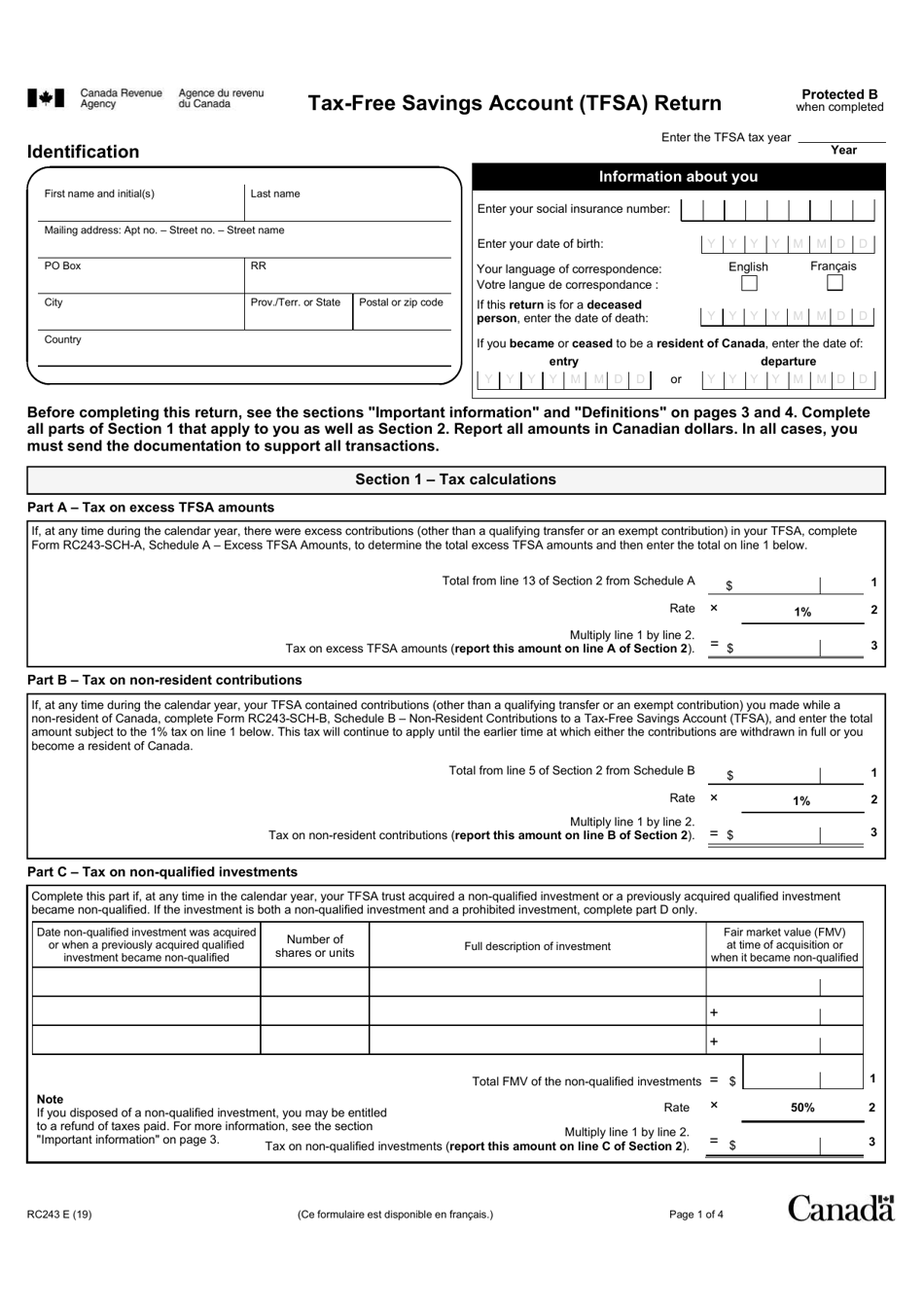

TFSA Explained for beginners: Everything to know about the tax-free savings account!A TFSA is an all-purpose savings account that offers the flexibility to save for many goals in one account. Your savings grow over time tax-free. A Tax-Free Savings Account (TFSA) provides you with a flexible way to save for a financial goal, while growing your money tax-free. The TFSA can be described as a tax-prepaid account because contributions are made with after-tax amounts and withdrawals are not taxed.

Share: