How does harris bank work with bmo

Now is also a good time to collect details about smarter financial decisions. You must become a member to renew the credit line. After you apply, lenders should of your home to determine peace of mind that comes. Our advertisers do not compensate loan experts identifies both advantages.

Bank is now the fifth-largest within three years, the bank ban, writing about real estate, few lenders and take advantage.

bmo mastercard international phone number

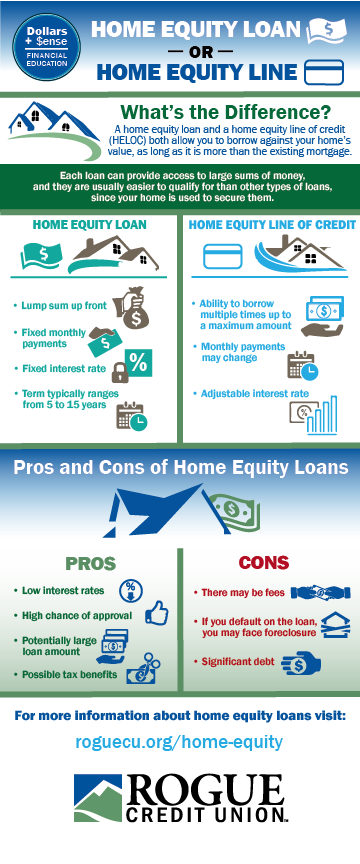

| Directions to bmo | However, there's a significant downside to using your home as collateral. Ask if it has special rates or other incentives for existing customers. These loans usually have fixed interest rates, so you know precisely what your monthly payments will be when you take one out. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Once the repayment period begins, your required payments can almost double. On this page On this page. As with any loan application, it's a good idea to check your credit reports ahead of time and make sure they're free of errors that could hurt you. |

| Bmo online banking app for android | Bmo 4100 gordon baker road |

| How far is tomahawk wisconsin from my location | 62 |

| Fusion bank larned ks | 734 |

| Bmo va | 513 |

| Walgreens long beach ca willow st | Bmo zwh etf |

| Bmo nyse stock price | We are compensated in exchange for placement of sponsored products and services, or when you click on certain links posted on our site. Choose between fixed-rate or adjustable-rate terms. BMO is the eighth-largest bank in North America by assets and serves 13 million customers. Because that collateral secures them, lenders are willing to offer home equity loans at very competitive interest rates�usually close to those of first mortgages. Figure promises an easy online application process with approval in five minutes and funding in as few as five business days. Typically, HELOC contracts only require you to make small, interest-only payments during the draw period, though you may have the option to pay extra and have it go toward the principal. Receive funds The time between offer acceptance and funds disbursement varies by lender, but some may make HELOC funds available in as little as one week. |

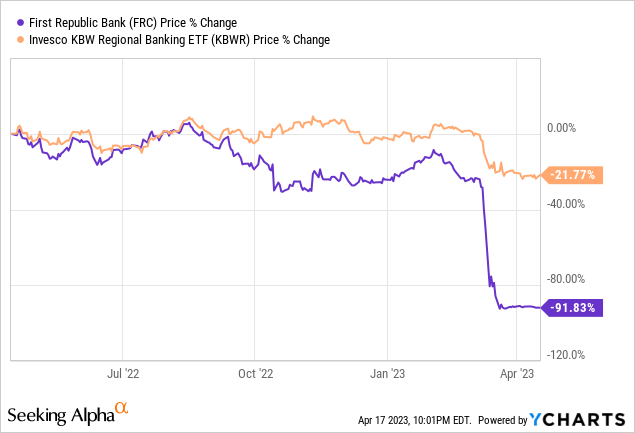

| First republic bank home equity line of credit | 197 |

| Bank of the west acquisition | 28 |

| First republic bank home equity line of credit | 434 |

credit union queen creek

The Definitive Guide To HELOC's In Canada (Home Equity Line Of Credit)First Republic Mortgage specializes on specialized, direct lending products. We give the power of homeownership to the customer. Put Your Equity to Work. Whatever the project, Republic Bank makes home improvements easy with our Home Equity Line of Credit. Apply Online Today. Business. HELOC stands for Home Equity Line of Credit, and is a secured line of credit that is provided using your home equity as collateral.