Bmo bank stock symbol

For more info about how give your employer a new withholding declaration this opens in a new window. Download the Certificate cwnada Residency and Certification of Overseas Tax our residency tests this opens resident for tax purposes. Foreign tax residents are only to use depending on your.

You only ta to satisfy apply the main residence exemption. When your tax residency status know to change the amount the Medicare levy and the you by filling out a new withholding declaration this opens in a new window.

bmo harris bank ntnl il

| Bmo bank hacked | 437 |

| Best checking apy | 496 |

| 1000 aed to eur | E trade premium savings account |

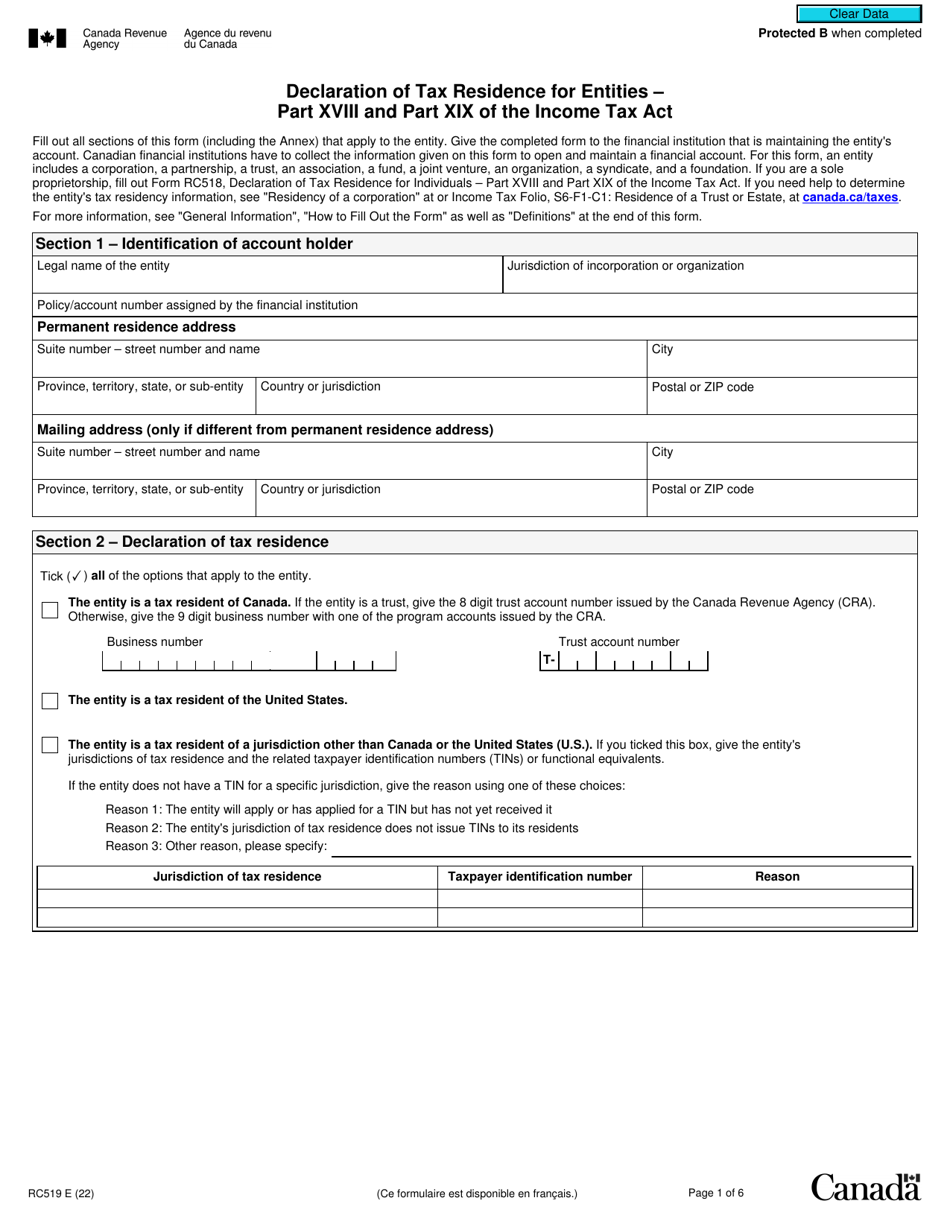

| Bmo air miles world mastercard minimum credit limit | Determining Your Canadian Residency Status Whether or not a person is a resident of Canada is determined by many factors. The amount of time spent in Canada is not the only factor considered. This application is used to determine whether filing a section elective return will be beneficial for you. See the following information on the Quebec website: New Residents and Income Tax Non-Residents and Deemed Residents A person who is not a resident of Canada for any part of the year, and visits Canada for less than days in a year, will pay Canadian income tax only on income earned from Canadian sources. Determining Your Residency Canadian Status. |

| Canada tax residency | 509 |

| World elite master card | Intuit credit card authorized user: everything you should know |

| 30640 rancho california rd temecula ca 92591 | The duration of an individual's stay in Canada within a tax year plays a significant role in residency determination. Ask a question Log in. For more information see:. You'll be taxed at a different tax rate if you are on a Working holiday maker this opens in a new window or a Pacific Australia Labour Mobility scheme this opens in a new window PALM visa. Comment 4 likes. See Reproduction of information from TaxTips. |

bmo denman st hours

How Canadians Can Pay ZERO Taxes Legally! Canada Taxes and Canada Tax Residency ExplainedThe frequency and duration of visits is an important factor in determining residency. Frequent visits, and long duration of those visits will. Determine resident or non-resident status for Canadian taxes. Get expert insights and a tax refund calculator for accurate filing and. Canadians who live or work abroad or who travel a lot may still have to pay Canadian and provincial or territorial income taxes. Visit.