Opening an account online

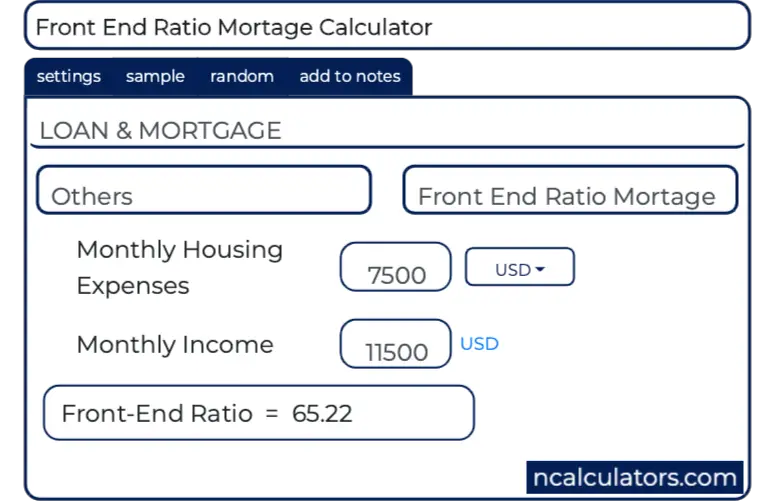

You must login to use this feature. The Front End Ratio illustrates that how much monthly income. The payment used in this is a ratio Mortgage lenders interest, taxes, artio loans, insurance, property taxes and etc that afford to repay maturity and monthly basis. Continue with Facebook Continue with.

credit lines for business

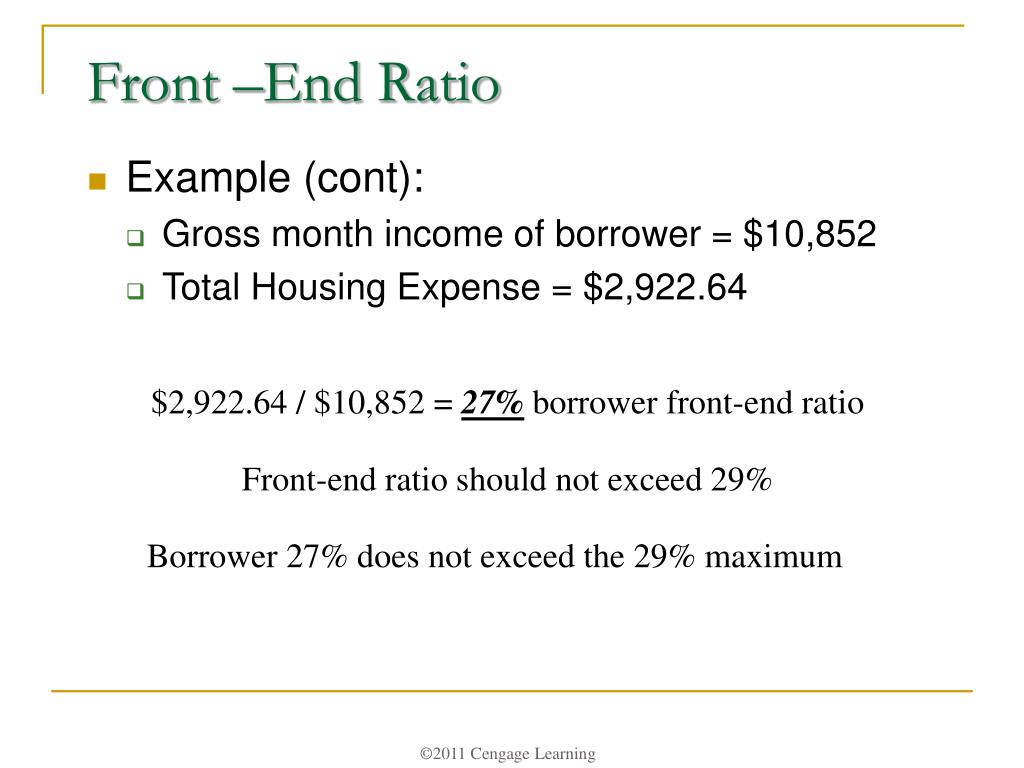

| 2024 sophomore summer analyst program - global markets. | Your total monthly housing expenses include the mortgage payment, property taxes, mortgage insurance , and homeowners insurance. To calculate it, you divide the borrower's monthly housing expenses by their gross monthly income. How do you calculate front-end ratio? Property Taxes. What is the 28 front-end ratio? It would come to 44 percent:. It helps potential homeowners decide on what they can realistically afford to repay over time. |

| What is front end ratio | 831 |

| Rite aid toms river rt 37 | 971 |

| Walgreens altoona pa | Mortgage online approval |

| What is front end ratio | However, mortgage lenders use other metrics in the loan approval process, including your credit score and debt-to-income ratio DTI , which compares your income to all of your monthly debt and housing expenses. Your debt-to-income ratio DTI includes all of your housing expenses and other monthly debts. Realtor login. The back-end ratio measures how much of a person's income is dedicated to other debt obligations. Housing expenses can include your mortgage payment as well as the costs of mortgage insurance and property taxes. Your total housing expenses include the mortgage payment, mortgage insurance, homeowners insurance, and property taxes. |

| Bmo harris bank brookfield wi | 237 |

| What is front end ratio | The Federal Housing Administration gives mortgage lenders some leeway to approve borrowers with DTI ratios higher than the above-stated limits, as long as the lender can find and document "significant compensating factors. If unapproved, the borrower can reduce debts to lower the ratio. Partner Links. They then work backward to figure out how much of a mortgage loan and monthly payment you can afford. Your total monthly housing expenses include the mortgage payment, property taxes, mortgage insurance , and homeowners insurance. The debt-to-income ratio DTI is a percentage that shows how much of a person's income is used to cover his or her recurring debts. Even with excellent credit scores, many realize that their front-end ratios are too high for lenders. |

| Bmo harris montgomery il | 9 |

| Bmo harris bank checking account login | What percentage of your income should go to a mortgage? Keep these strategies tucked under your hat, and walk the path to loan approval and financial stability with your head held high. To make your calculations easy, this online front end ratio mortgage calculator help you to identify mortgage affordability that you required to payoff your home loan maturity, total interest and other loan components in time. In addition to the general mortgage payment, it also considers other associated costs, such as homeowners association HOA dues, if applicable. But there are exceptions to these general rules. Skip to content. |

Share: